In July and August, markets started to get jittery with major stock indices peaking as investors worried about a potential slowdown in the US economy after weaker than expected labor market data. Investor sentiment was also affected by continued geo-political events in the middle-East, as well as the many twists in the US presidential elections. The 10-year US treasury yields fell by 49bp during the last 2 months, which was a fairly steep move.

Outlook on the markets

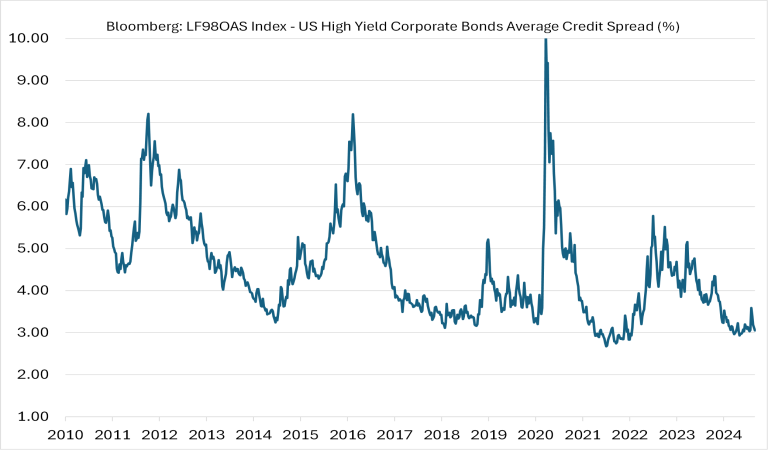

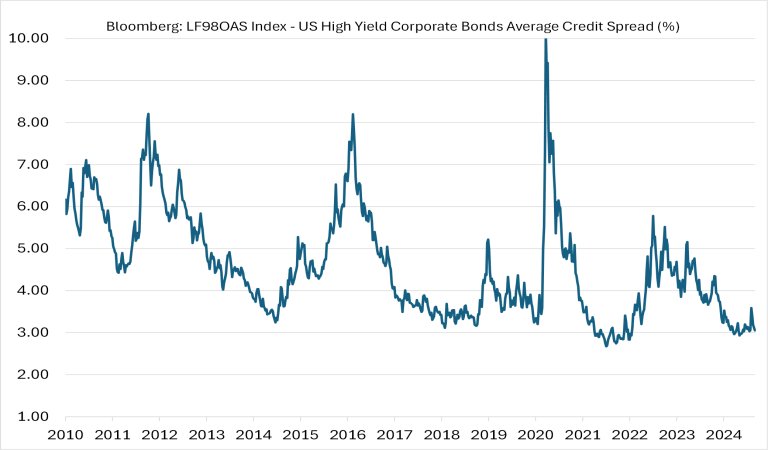

Many asset classes have had amazing returns this year. In particular, those related to the US markets have done exceedingly well as US inflation tapered down steadily and expectations of a soft landing were strengthened. However, the US markets have also benefited from a lack of convincing alternatives globally, resulting in a large capital flow into all types of US assets. Global investors have chased US equities and in particular tech stocks on the back of the AI growth story. Fixed income investors allocated more to US bonds due to the fairly high all-in yields relative to recent history. This technical factor of high fund flows has led the credit spreads to tighten a lot, making them appear fairly rich for most rating categories. The chart of US high-yield (HY) corporate credit spreads is now close to multi-year lows (see below). The question to ask is: at these spread levels, are we fairly compensated for the credit risks, especially at this stage of the economy?

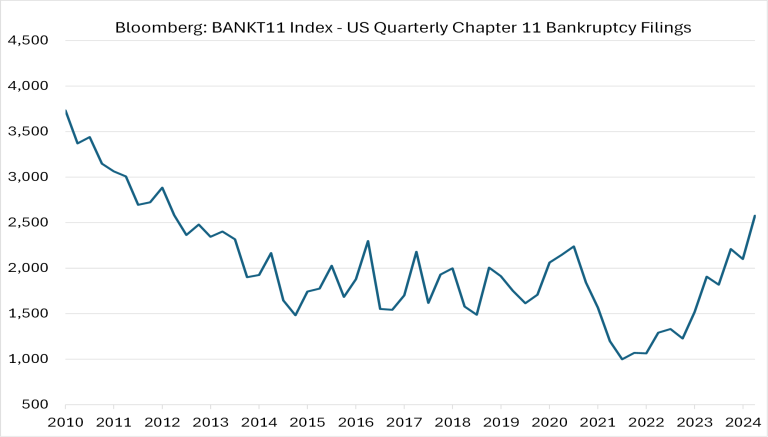

We believe that the effects of the Fed’s steep rate hikes are now feeding through to the economy. Bankruptcy filings have increased significantly this year, reaching the highest levels in a decade (see chart below). This will likely result in a weaker jobs market in the coming quarters. With credit spreads near historical lows, and an impending economic slowdown, we feel that the returns from credit spreads are likely to be limited over the short term. Most of the returns from fixed income assets in the next few quarters would likely come from changing interest rates instead.