The market’s focus during October was the US elections and the consequences of victory of each side. As betting markets tilted towards a likely Trump victory and the Democratic camp felt less optimistic, the market traded based on a likely Trump victory. 10-year US Treasury yields widened dramatically by 50bp, as Trump’s stated policies are projected to increase fiscal deficits and re-ignite inflation which would lead to a lower probability of Fed rate cuts.

Credit markets continued to tighten as investors continued to chase the higher all-in yields. As a result, US IG spreads tightened further by 5bp from 89bp to end the month at 84bp, which is tighter than most credit strategists’ year-end targets. Even the US HY spreads tightened by 13bp from 295bp to 282bp, reaching close to the lowest levels in a long time.

Equity market Vs Bond market valuations

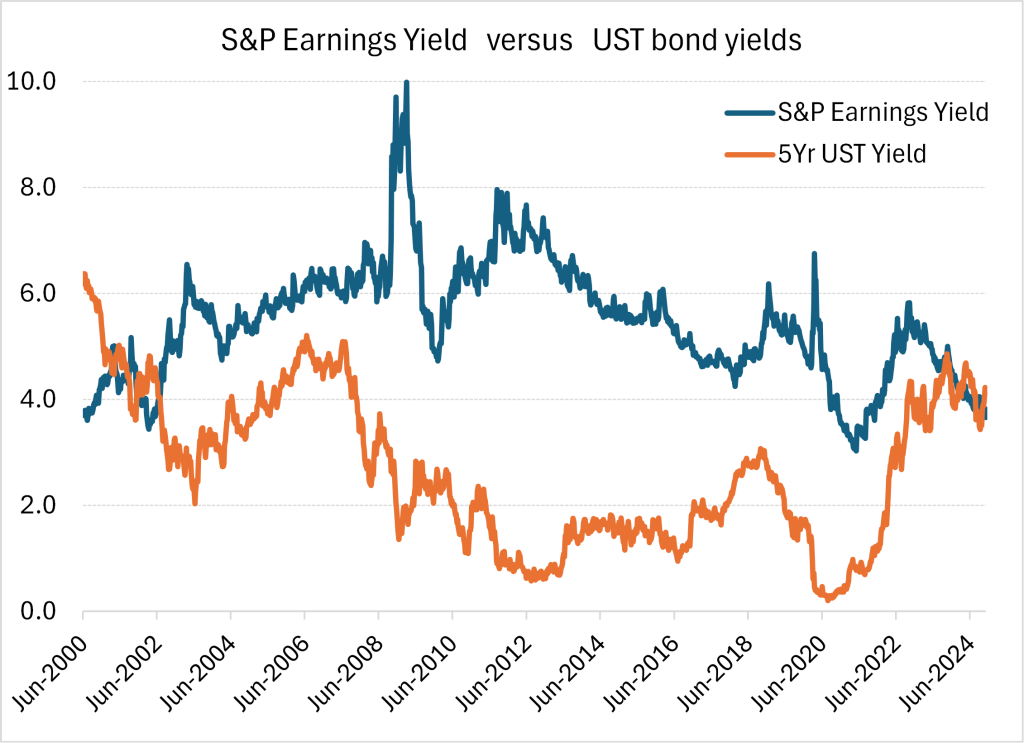

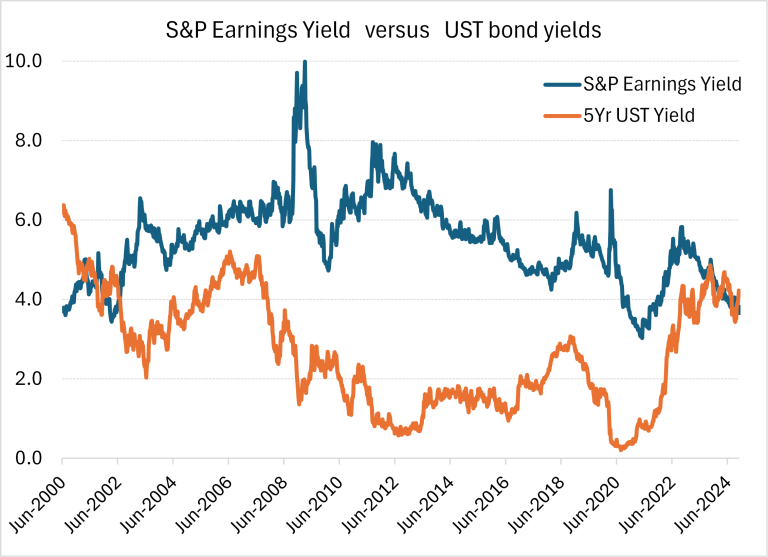

Equity market indices are setting all-time high records every month. It is as if the market believes that a growth slowdown is definitely not going to happen. Forget “Soft-landing” scenario; people are now tilting towards a “No-landing”. However, valuations also seem to be pricing-in a no-landing scenario already. The chart below shows the 5-year UST yield versus the S&P 500 Index’s earnings yield (E/P, which can be viewed as 1 / (P/E) ). With S&P 500 now trading at 25x P/E, the 5-year UST yield is higher than S&P 500’s earnings yield, meaning that you get paid more by bonds than the companies are earning for you on your stocks. This has rarely happened before. The last time it happened was in 2000, after which stocks were down 45% in the following 2 years.

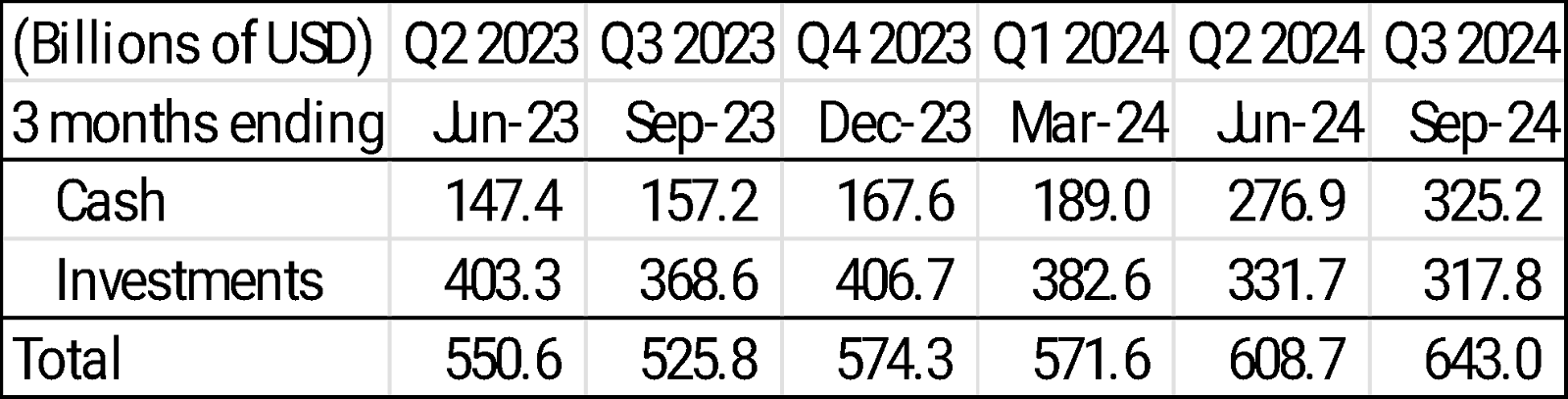

Warren Buffet has recognized this over-optimism for stocks. The table below shows the trend in Berkshire Hathaway’s cash versus stock balances in the last few quarters:

Just in the last 2 quarters, Buffet has shifted massively from stocks to cash, selling over $125 billion of stocks. He is now sitting on $325 billion of cash! This is higher than his stocks position – the first time it’s happened in a long time. Clearly, he thinks that the returns on cash plus the option value of being in a highly liquid position would likely beat the expected returns on stocks in the short term. Given Buffet’s stellar track record, one should try to be on his side.

Of course, equities are nominal assets, and earnings could zoom if inflation picks up again just as they did in the last few years. But inflation seems to have subsided, at least for now. So, based on this factor at least, the earnings growth rate should moderate.