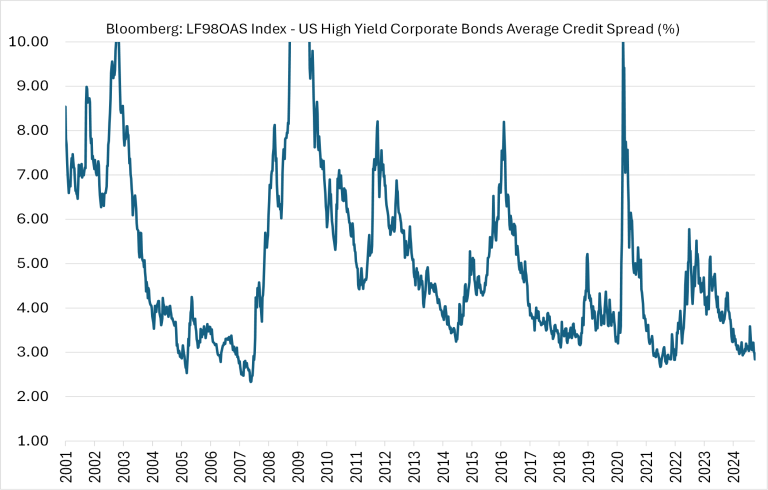

The much-anticipated Fed rate cuts finally started in September. Fed Chair Powell indicated that their larger than expected 50bp cut did not indicate concern about the economy. Stock markets took this positively as expectations of a recession or growth slowdown receded. The major equity indices resumed their upward trend. Credit spreads also tightened further – the US IG Corporate spreads tightened 4bp to reach 89bp, while the US HY spreads tightened 10bp to reach 295bp.

Fed rate decisions – a tough job

The rate setting committee of the US Fed has a tough job. They had to tame the surge in inflation post Covid with a steep increase in rates, but also needed to monitor that the high rates didn’t hurt growth and employment. As the unemployment rate slowly crept up in recent months, several commentators argued that the Fed was already behind the curve. This was despite the Fed clarifying that a larger driver of higher unemployment rate was the higher labor participation rate rather than a reduction in the number of jobs. Clamours increased for a large 50bp cut, almost forcing the Fed’s hand, as otherwise there would be market tantrums which could eventually affect consumer confidence.

But we should note that the US economy is very large, which gives it massive momentum. In comparison, the Fed’s basic tool of overnight rates is quite small. So the Fed’s task is like keeping a 50-ton tank moving at constant velocity while only having the engine and brake of a small car. They must also be mindful of the changing terrain (new economic data, unpredictable geopolitical events, changing confidence levels, etc.). Arguably it is a very tough job. Commentators who make exhortations to the Fed about rate cuts or otherwise should put themselves in the Fed committee’s shoes before making their prescriptive statements. Instead, the commentators have changed their own views many times already – from predicting several cuts, to no cuts, to several cuts again.

Credit market has lower correlation to Fed

A dovish Fed may be good for shorter duration treasury bonds. But usually, when the Fed starts a sequence of rate cuts, it is with the outlook of a possible slowdown in growth which in turn implies slower corporate earnings growth. Such a situation would typically lead to wider credit spreads and hence the total financing cost for companies doesn’t immediately reduce in line with Fed rate cuts. In any case, the debt stacks of most companies have a multi-year duration, so refinancing the debts at lower rates would take a long time. Therefore, corporate credit spreads move less based on Fed rate moves, but more due to other factors such as the sector’s prospects, general market sentiments, fund flow technicals, excess cash liquidity in the system, etc.

In the current situation, the Fed has cut rates only as an anticipatory move, while economic growth is still fairly robust. The above-mentioned factors which affect credit spreads are also broadly supportive. This has kept credit spreads stable and there doesn’t seem to be any immediate reason for concern. That said, the absolute spread levels are near historic tights (see chart below), leaving little room for much further upside from spread tightening.